Lesson 4: Measuring GVC participation and Analyss of special GVC

In this lesson, we delve into the methods for measuring participation in Global Value Chains (GVCs) and analyze the unique characteristics of the automotive industry as a specific GVC case.

- Measuring GVC Participation Understanding how countries engage in GVCs is crucial in today’s globalized economy.

1.1 Trade Statistics Challenges

- Traditional trade statistics record goods and services flows on a gross basis, leading to double-counting of intermediate inputs as they cross borders multiple times.

- To address this, researchers use the concept of “trade in value added,” which breaks down gross exports by the country and industry of origin and destination of value added.

1.2 Indicators of GVC Participation

- GVC participation indicators track countries’ involvement in GVCs and reflect production process fragmentation.

- Participation is often calculated as the share of GVC-related trade over gross exports.

- It considers both backward (upstream) and forward (downstream) linkages.

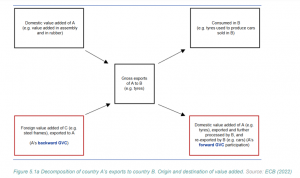

1.3 Backward and Forward Participation

- Backward participation measures the share of foreign value added in a country’s total gross exports.

- Forward participation tracks domestically produced value added re-exported by the destination country.

- An example of tire production illustrates these concepts.

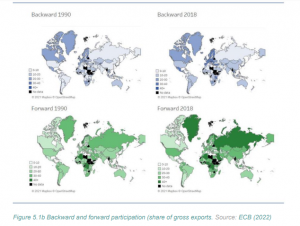

1.4 Variation in GVC Participation

- Countries’ engagement in GVCs varies based on their role in the production process.

- Different regions and economies show different patterns of backward and forward linkages.

- Policies and industry structures influence participation levels.

- Analysis of Specific Global Value Chains: Automotive Industry Now, let’s apply these concepts to understand the automotive industry’s global value chain.

2.1 Structure of the Motor Vehicles Industry

- The motor vehicles industry has seen extensive international production fragmentation.

- A hierarchical structure with lead firms on top and a network of suppliers below is common.

- Large automotive manufacturers focus on design, branding, and final assembly.

2.2 Regional Production in the Automotive Industry

- Despite globalization, regional production remains important due to high transportation costs.

- Political pressure also encourages production near end markets.

- Supplier networks consist of local and global suppliers.

2.3 Global Presence of Lead Firms

- Lead firms in the automotive industry demand global presence and system design capabilities from suppliers.

- Countries like China, Indonesia, Thailand, and Malaysia have increased forward participation.

- Emerging Europe integrates downstream into Western European supply chains.

2.4 Motor Vehicles’ GVCs and International Production Stages

- The motor vehicles industry exhibits extensive global value chains.

- Smaller countries with significant car assembly activities depend more on imported intermediates.

- Countries like Korea, China, and Japan have domestic production stages.

2.5 Participation and Distance to Final Demand

- Participation in GVCs varies with the importance of imported intermediates.

- Countries with high participation rates often have intermediates located closer to downstream production activities.

- Mexico specializes in car assembly for local and Latin American markets.

- Mapping the Automotive Industry

- Central European countries integrated into Western European production systems in the 1990s.

- FDI played a significant role in restructuring state-owned industries.

- Two-way trade in vehicles between Western and Central Europe increased.

- Integration resulted in a regional production system characterized by high interdependence.

Conclusion:

- Trade Statistics Challenges: Traditional trade statistics can lead to double-counting of intermediate inputs, making it essential to use the concept of “trade in value added” to understand the true contribution of countries to global trade.

- Indicators of GVC Participation: We examined indicators that track a country’s engagement in GVCs, including both backward (upstream) and forward (downstream) linkages, providing insights into how countries fit into the global production process.

- Variation in GVC Participation: Countries’ roles in GVCs vary based on their position in the production process, influenced by factors such as policies, industry structures, and regional dynamics.

- Automotive Industry Insights: We applied these concepts to the automotive industry, showcasing how it features a hierarchical structure, global presence of lead firms, and significant regional production despite globalization.

- International Production Stages: Understanding the number and location of international production stages is crucial in analyzing the depth and breadth of GVCs in different industries.

This lesson has equipped you with the knowledge to measure GVC participation accurately and analyze the dynamics of specific GVCs, such as the automotive industry. These insights are valuable for comprehending the intricate interplay of countries and industries in the globalized economy.